ETHZilla will buy $350 million worth of Ethereum and make a profit on it.

EfiriumTreasury company ETHZilla will invest another $350 million in ETH and will receive passive income from digital assets.

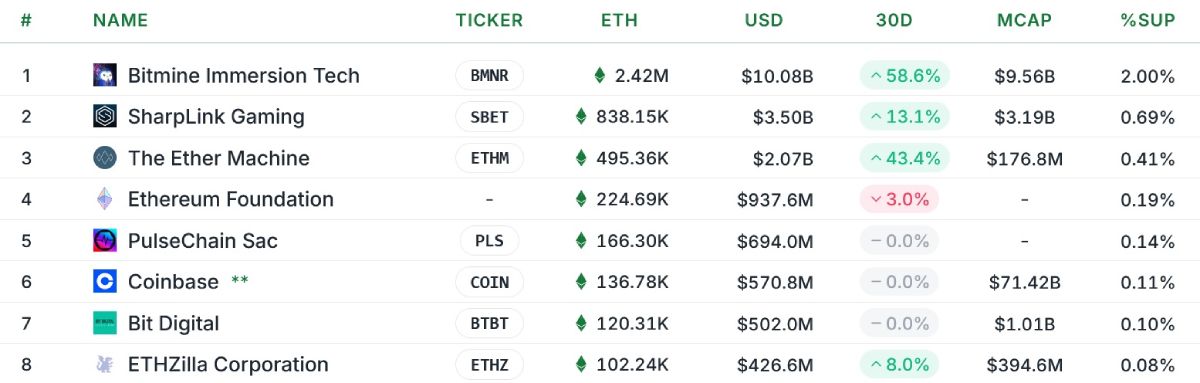

The company began investing in cryptocurrency in July 2025 and purchased 102,240 ETH worth $426,6 million at the current exchange rate. This metric places the company eighth among publicly traded organizations with the largest holdings of Ethereum.

Top 8 Companies by ETH Investments

However, ETHZilla’s management intends to continue increasing its Ethereum reserves and plans to sell convertible bonds worth $350 million to this end. The proceeds will be spent on ETH, and the purchased coins will be used to generate income. These will be invested in protocols running on the ETH blockchain that allow for profit-making. These are likely lending and staking platforms.

ETHZilla continues to actively invest in the Ethereum ecosystem, providing strategic support to a wide range of protocols and promoting innovation, long-term network growth, and revenue stream differentiation, ETHZilla employees said.

ETHZilla has already generated 1,5 million digital assets using Ethereum, the names of which remain secret. In this regard, the company’s business model differs from its tactics. Bitcoin- treasury firms, such as Strategy, which don’t invest the BTC they purchase to avoid the risk of theft. Therefore, $75,45 billion worth of bitcoins sit as dead weight on Strategy’s balance sheet, earning no profit for the institution.