Ethereum has retreated to $4000, but analysts expect a wave of accumulation.

The course Ethereum ETH has fallen more than 6% in the last 24 hours to $4172, its lowest level since early August. This decline has wiped billions of dollars from its market capitalization, which now stands at approximately $503 billion.

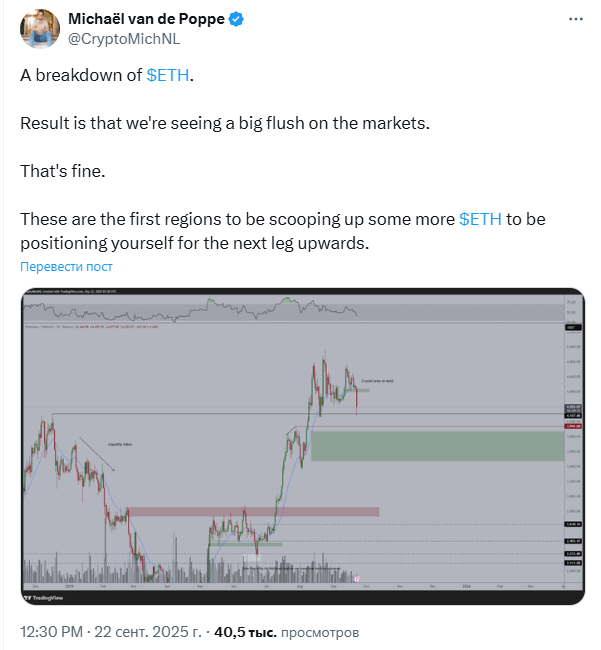

However, analysts believe this could be the beginning of the next phase of accumulation. This opinion is shared by Michael van de Poppe, who considers the $4100–$4000 range to be a long-term investment area.

According to his chart, if ETH manages to stabilize and regain its position, the next important target will be located near $5766.

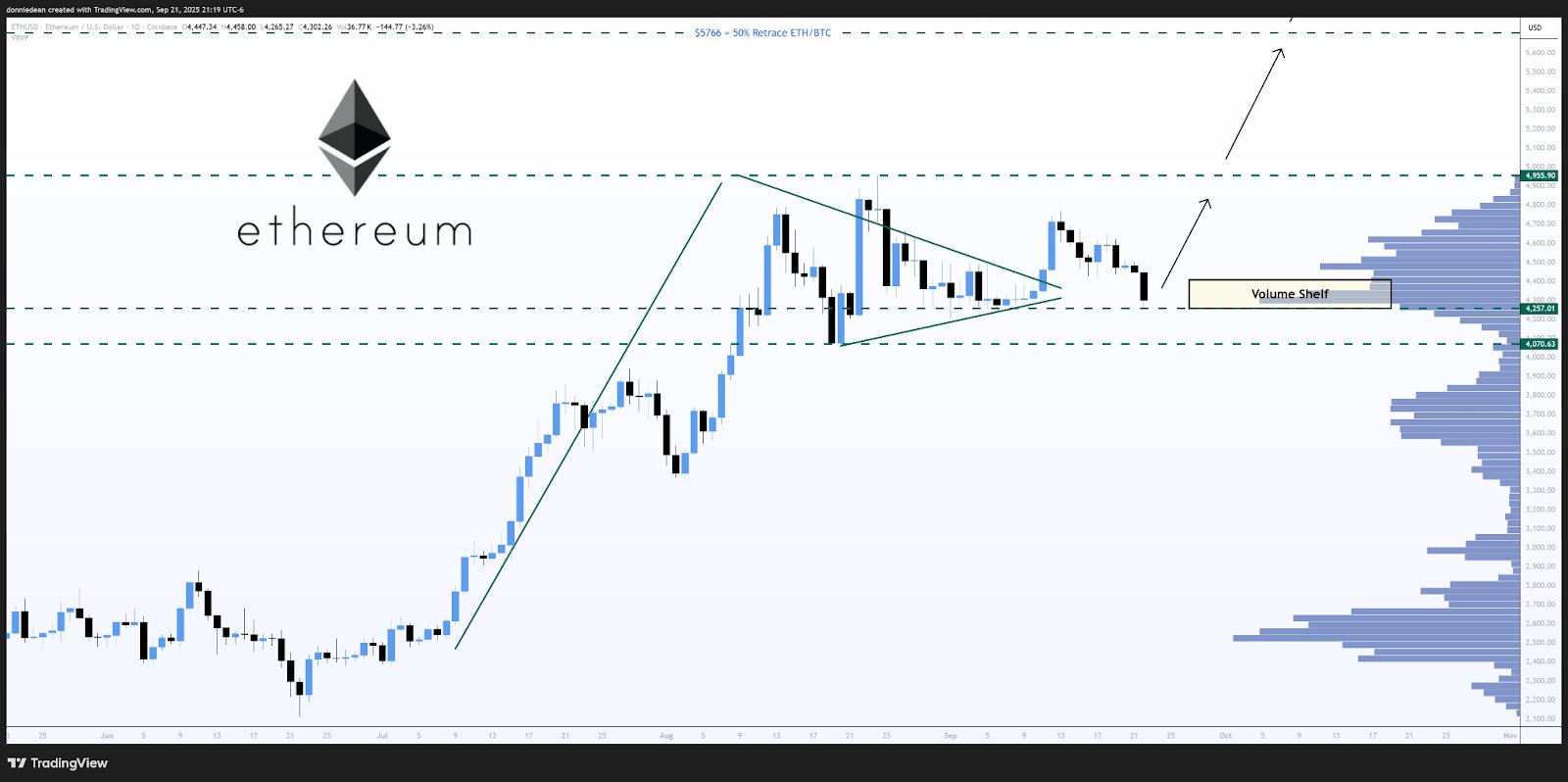

Donald Dean’s data on X

Conversely, failure to hold above $4000 could trigger a deeper correction to the $3600–$3800 range, where stronger momentum is observed. liquidity.

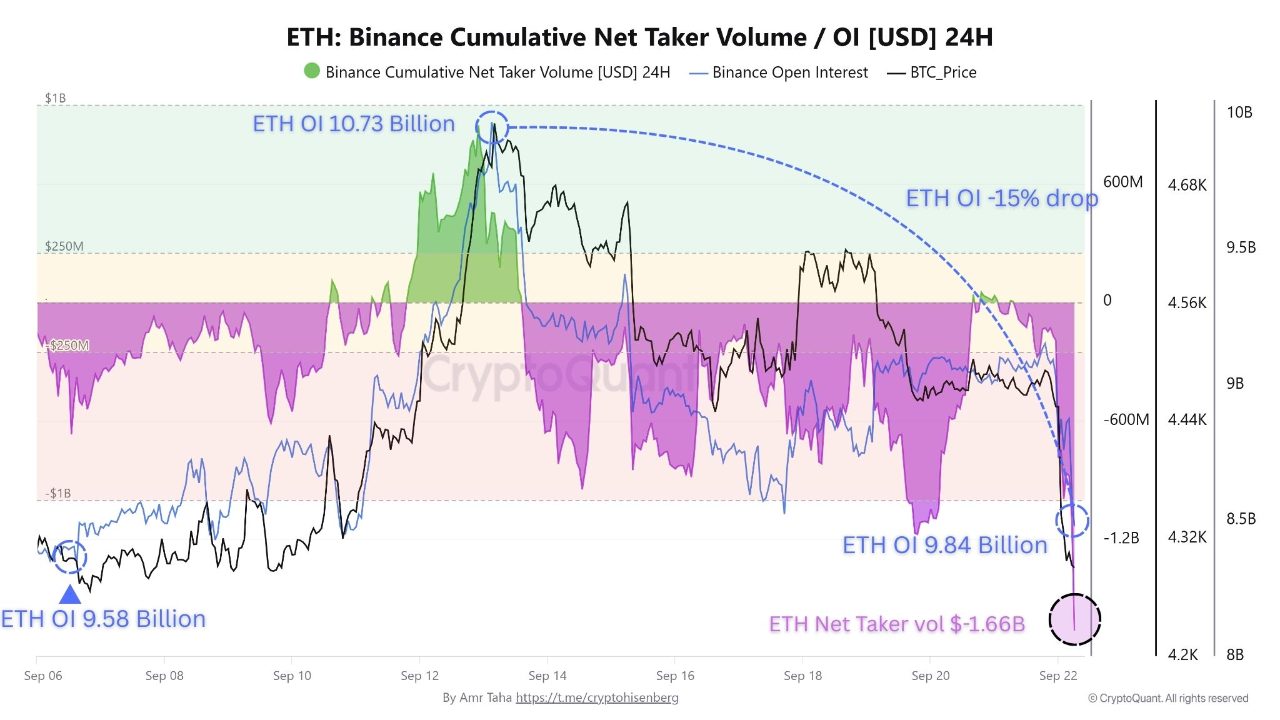

According to CryptoQuant, open interest in ETH has been on the rise since mid-September. Binance fell by about 15%, returning to levels last seen at the beginning of the month.

Net taker volume has turned deeply negative, indicating aggressive selling pressure, while funding rates on major exchanges have moved into negative territory.

CryptoQuant Data

Clearly, short positions are dominating, while longs opened at higher prices have been closed. Historically, such conditions at key support levels often coincide with capitulation and oversold conditions.