$332M Inflow into BTC ETF Ends ETH ETF Dominance

Tuesday Bitcoin- funds outperformed эфириум-ETF by the volume of investment flows.

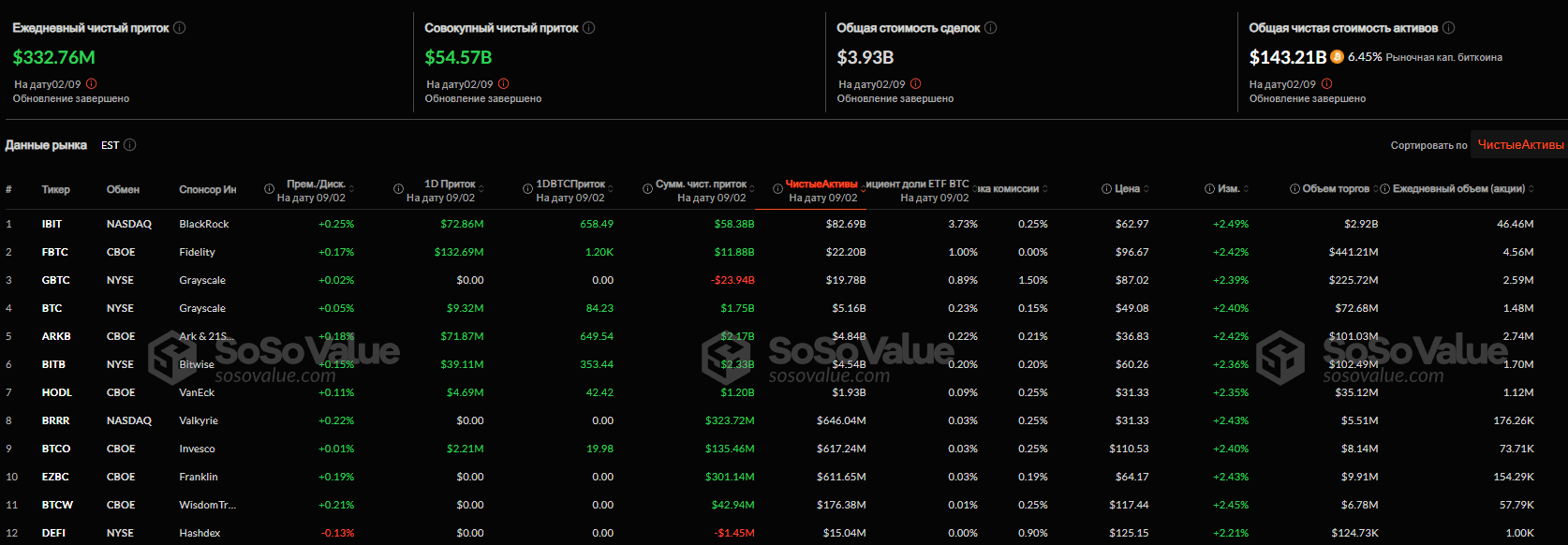

According to SoSoValue, on September 3, there was a net inflow of funds into spot BTC-ETF amounted to $332,7 million, of which $132,7 million came from Fidelity’s FBTC and $72,8 million from BlackRock’s IBIT. Funds from Grayscale, Ark & 21Shares, Bitwise, VanEck and Invesco also saw inflows.

Meanwhile, Ethereum-based ETFs saw a net outflow of $135,3 million, with $99,2 million leaving Fidelity’s FETH and $24,2 million leaving Bitwise’s ETHW.

Transfer of funds from ETH to BTC via ETF suggests that institutional investors may be rebalancing portfolios to benefit from Bitcoin’s perceived stability in the face of macroeconomic uncertainty, said Nick Ruck, director of LVRG Research.

In August, ETH-ETF surpassed bitcoin ETF, as analysts pointed to a “balance shift” towards Ethereum amid growing demand for the leading Altcoyin from corporate treasuries. Thus, in August, there was a net outflow of funds from Bitcoin- funds amounted to $751 million, the indicator эфириум-ETF over the same period exceeded $3,87 billion.